Important Things You Should Know

Here are some important information you should know before you go to the USA.

Before we even start, we want you to know that if you don’t care for your money, no one else will. So let us lead you through some basic information about taxes and documents for tax purposes that you will need in order to get your money back.

US law requires you to pay federal, state and local taxes. As US tax laws can be

confusing, many people think - ‘Why bother filing a tax return? ’ Well, everyone who

visited the USA on a J-1 visa is required by law to file a tax return and it is important to

comply with US tax laws.

So, once again, as a J-1 visitors, you must file annual income tax reports with the

Internal Revenue Service (IRS), which is the U.S. government agency responsible for

collecting federal taxes and other state authorities. Generally, your employer will deduct

money from your paycheck every pay period. As an income-earning individual, you will

be taxed on income from salaries, wages, and tips. Your employer will submit the

amount withheld directly to the federal government. Deductions for state and local taxes

will vary. Some states do not have a personal income tax. Similarly, local taxes will vary

but will be significantly less. If no taxes are withheld from your pay, please contact us.

The due date for filing your tax return is generally April 15 of the following year. If April 15 falls on a weekend, the due date is the next work day that is not a holiday.

Do not forget that you as a nonresident alien are not suppose to pay same the same taxes as a resident. Please be aware of the following:

You do pay:

Federal income tax

Medicare tax (FICA)

Federal Unemployment Tax (FUTA)

You do not pay:

Social Security tax (S.S.T.)

State income tax

Local or city income tax

FICA (Social Security and Medicare) taxes – represent pension and health insurance. FICA tax rate is 15.3% off the earnings. Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45% , respectively. So each party pays 7.65% of their income. If FICA has been withheld from your wages by mistake (look in box 4 of your W-2 form), you should first ask the employer who withheld the tax for a refund. If the employer does not grant a refund, a refund can be claimed from the IRS, contact us for more information.

If you see deductions that say FICA, FUTA or Social Security Tax, please notify your employer promptly. If your employer is unable to issue a refund contact us.

Please note: some states may deduct state unemployment taxes, which you are required to pay.

New Tax Regulation

Starting January 1, 2018 (until 2026) the personal exemption has been suspended. In the past, students may have received refunds from the federal government. Due to these tax law changes, students may receive significantly smaller refund or even owe money to the IRS. State taxes are not affected by this act, and are dependent on the state you worked in. You may still be eligible for a State refund regardless of the amount you earned.

In order to have no issues with your tax return process you have to know some basic information about the documents that are important for the process of getting your tax refund.

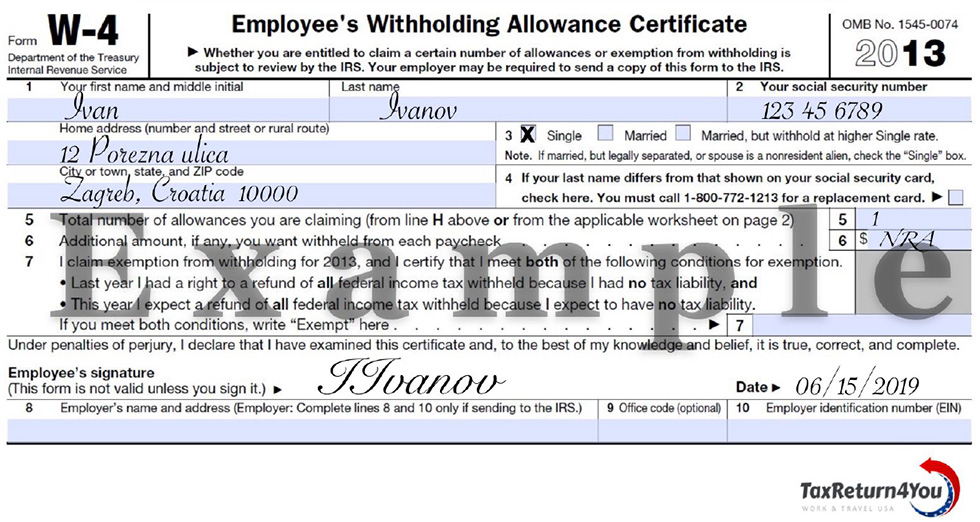

Before you start working in the US your employer will provide you with the paperwork you have to fill out so you can legally work in the US. First document that is very important for tax return purposes is Form W-4.

W-4 Employee's Withholding Allowance Certificate Form or better known as a W-4 Form

What is W-4 form? Why is it important and how to fill it out correctly?

The instructions printed on the W-4 form are made for U.S. residents so even if your employer tells you to follow them, please don’t. The instructions on the W-4 Form are for U.S. residents only; not for you. Please follow the instructions below in order to fill out your W-4 correctly:

Line 3: Check only "Single" marital status on line 3 (regardless of actual marital status).

Line 5: Claim only “1” withholding allowance on line 5. If you are a resident of Canada, Mexico, South Korea, a U.S. national, or a student or business apprentice from India visit U.S. Tax Guide for Aliens.

Line 6: Write “Nonresident Alien” or “NRA” above the dotted line on line 6 of Form W-4. As an Exchange Visitor on a J-1 Visa, you are considered a "non-resident alien" for tax purposes.

Line 7: Do not claim “Exempt” withholding status on line 7. Leave this line blank.

It is very important to fill out this form correctly because some mistakes could potentially reduce the amount of your tax return or could cause other issues with your tax return.

For tax purposes, you are required to fill out this form (W-4 Employee's Withholding Allowance Certificate) as soon as you start working. Your employer will give you a W-4 Form. It is your responsibility to complete and submit the W-4 Form to your employer. Based on the information you provide on the W-4 Form, your employer will calculate the amount of federal, state, and local taxes to be withheld from your paycheck.

Pay Stub

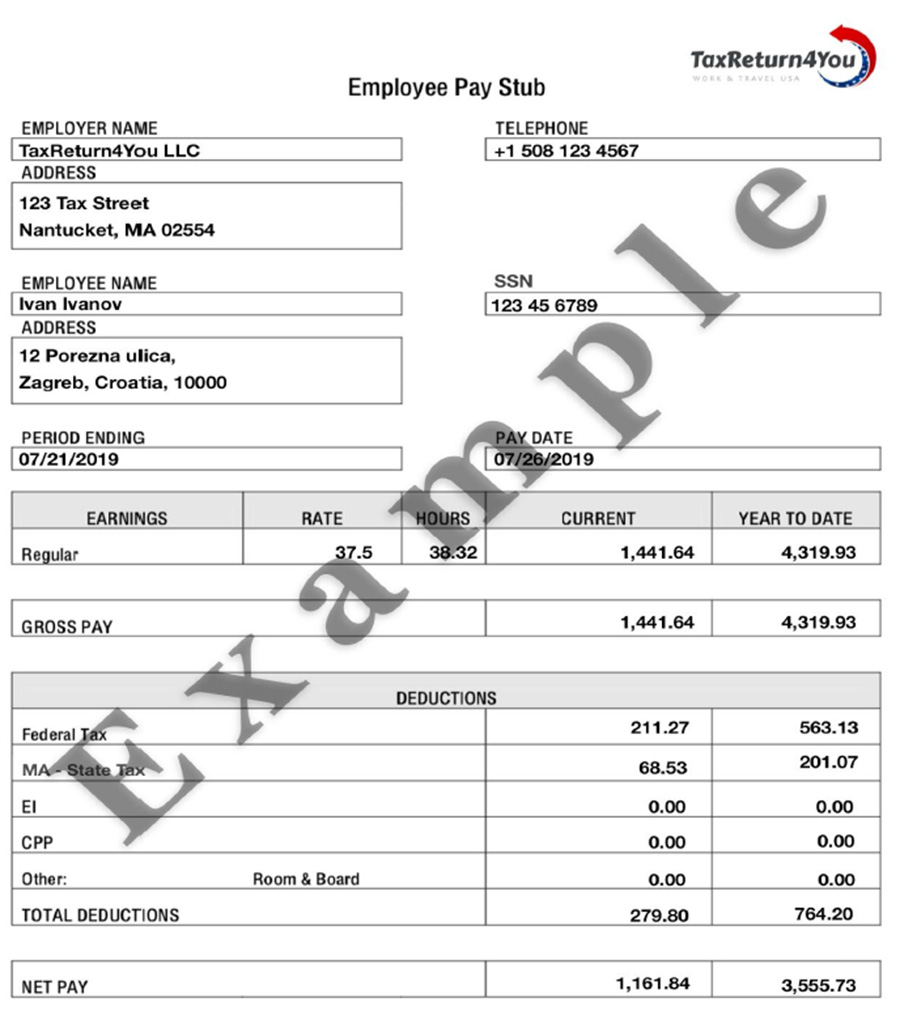

What is Pay stub, how to read it and how to understand it better?

A pay stub is part of a paycheck that lists details about the employee’s pay. It itemizes the wages earned for the pay period and year-to-date payroll. The pay stub also shows taxes and other deductions taken out of an employee’s earnings. And, the pay stub shows the amount the employee actually receives (net pay).

A pay stub has many different components. Below, we’ve outlined some common terms you’re likely to see on your pay stub and explained what each of them indicates. (Keep in mind that some pay stubs may include some or all of the below information. Others may include other components or different terms for the pieces listed here.)

In order to make sure that you are paying the correct taxes, check your first pay stub.

Gross Pay: Total amount earned in the pay period before any tax deductions.

Withholdings: Amount of money the Federal, State and local governments take out of your

paycheck.

Net Pay: Total amount of earnings you will receive after taxes have been taken out.

YTD or Year To Date: The total amount of earnings and withholdings since January 1st of the

current calendar year.

Note: It is very important to save final pay slip because if you for some reason do not get your W-2 Form, we will be able to make your tax return from the information printed on your last pay slip.

Important: Pay slips are not documents intended for filling a tax return, and filing them instead of your W-2 form can cause complications and extend the whole refund process.

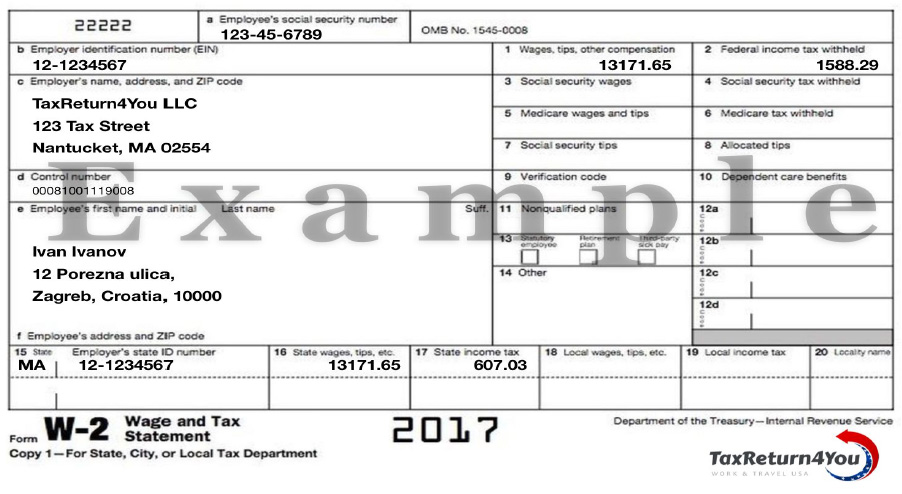

W-2 Form

What is W-2 Form and why is it important?

At the end of a fiscal year, employers are obligated by law to give their employees the W-2 Form which contains information about your yearly earnings and paid taxes. This form is the most important one for getting a tax refund. The number of W-2 forms should be equal to the number of jobs one had in the USA. Employers are legally obliged to postmark and send the W-2 forms to their employees not later than January 31 of the following year by regular mail. In order to make sure that the employer sends the W-2 form to the right address, it is of utmost importance to correctly fill out the W-4 form when being hired. The address listed in this form is the address to which W-2 form is going to be sent.

If you do not get the W-2 form, you can claim your taxes by filing your last pay slip. Pay slip is a part of a paycheck which remains in your possession after cashing the check. The final paycheck, i.e. pay slip, contains the same information as the W-2 form, which is why it is important to save the final pay slips from all of your employers.

Important: Pay slips are not documents intended for filling a tax return, and filing them instead of your W-2 form can cause complications and extend the whole refund process.

And that is pretty much it. So keep in mind that you worked too hard to not take what belongs to you. So let’s get started

English

English

Croatian

Croatian Serbian

Serbian Montenegro

Montenegro